New Props on the Block

Best New Prop Trading Firms

1. Bulenox

Bulenox is a proprietary trading firm that offers traders the opportunity to manage funded accounts in futures and options markets. They provide various account sizes ranging from $25,000 to $250,000, with profit targets and drawdown limits tailored to each tier. Traders can retain up to 90% of their profits, depending on the account type.

Features of Bulenox:

- Evaluation Process: Offers funded accounts to traders after they pass an evaluation phase.

- Platform Support: Includes Rithmic, ProjectX

- Profit Sharing: First $10,000 in profits: 100% of this amount goes directly to the trader.

- Trading Rules: Offers two primary account types for options trading: Option 1 with a trailing drawdown and Option 2 with an end-of-day (EOD) drawdown. Each has distinct rules and features tailored to different trading strategies.

- Automated Trading: Permits automated trading, including the use of algorithms, bots, and expert advisors (EAs)

- Account size up to: $250,000

Pros

- High-profit split of 90%.

- Diverse Account Options

- Multiple Withdrawal Methods

Cons

- Strict rules against automated trading.

- No free trials or free repeat evaluations.

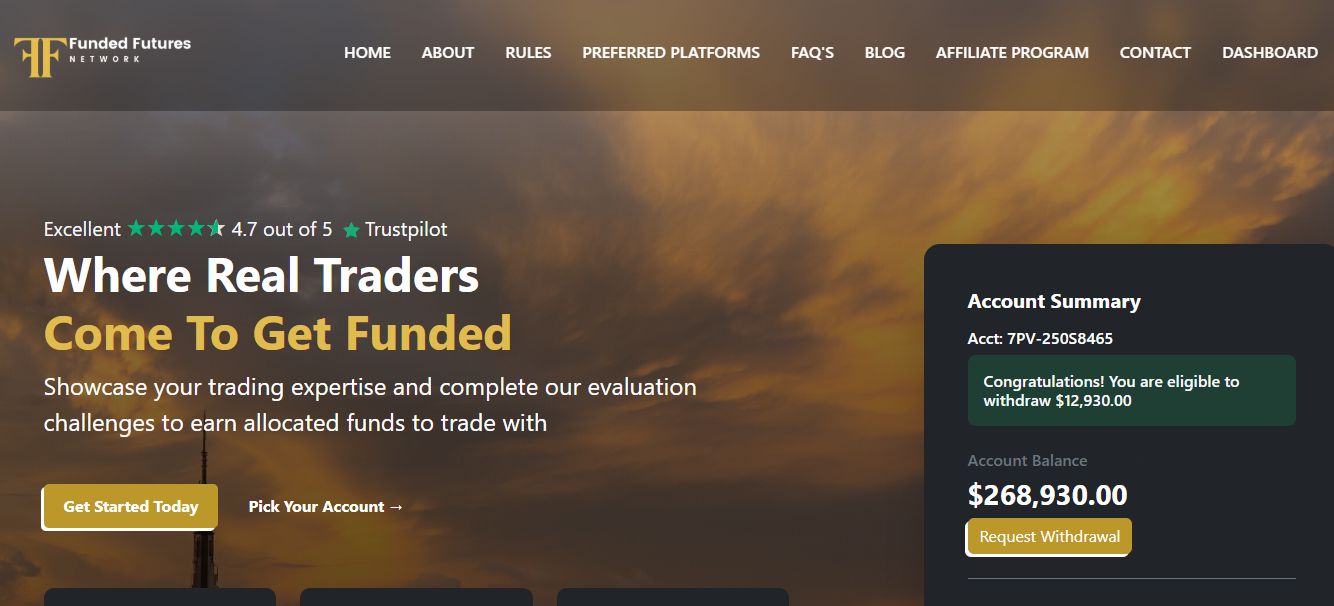

2. Funded Futures Network

Funded Futures Network (FFN) is a proprietary trading firm established in January 2023, offering futures trading opportunities to both novice and experienced traders. The firm provides a structured evaluation process, allowing traders to demonstrate their skills and potentially secure funded accounts with FFN.

Features of Funded Futures Network

- Evaluation Process: offers a structured evaluation process for traders seeking to access funded futures trading accounts.

- Platform Support: Includes Rithmic, Quantower, Edgepro, MotiveWave, Mobile

- Profit Sharing: The profit split is 80/10.

- Trading Rules: Traders must achieve a profit target typically around 6% of the account balance during the evaluation phase to qualify for a funded account.

- Account size up to: $$250,000

Pros

- Generous Profit Split

- Large Account Size

- Daily Withdrawals

Cons

- Monthly Subscription Fees

- Strict Consistency Rules

3. Lucid

Lucid Trading is a proprietary trading firm that offers traders a clear and straightforward path to live capital. Their model emphasizes transparency, fast payouts, and real opportunities for skilled traders.

Features of Lucid

- Evaluation Process: to assess and develop traders through a structured, multi-phase program.

- Platform Support: Includes Rithmic, Quantower, MotiveWave

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Stick to risk management parameters; no reckless trading allowed.

- Account size up to: $200,000

Pros

- Transparent Evaluation Process.

- Fast Payouts

- High Profit Split

Cons

- Limited Scalping Options

- Platform Limitations

4. Tradeify

Tradeify is a proprietary trading firm that has garnered attention in the trading community. While it offers attractive features for traders, there are several aspects to consider before engaging with the platform.

Features of Tradeify

- Evaluation Process: Traders must meet the specified profit target for their chosen account size.

- Platform Support: Supports Tradovate, Tradingview, Ninja

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Traders must meet the specified profit target for their chosen account size.

- Account size up to: $150,000

Pros

- Scalable Account Sizes

- Attractive Payout Structure

- End-of-Day Trailing Drawdown

- No Activation or Evaluation Fees

Cons

- Inconsistent Rule Enforcement

- Delayed Payouts

- Hidden or Unexpected Fees

5. Traders Launch

Traders Launch is a proprietary trading firm established in 2023, offering futures trading with a focus on transparency and trader support.

Features of Traders Launch

- Evaluation Process: ensures that traders are qualified and strategies are viable before real capital is deployed.

- Platform Support: Rithmic

- Profit Sharing: The profit split is 80/20.

- Trading Rules: No single trade or day should account for more than 40% of profits.

- Account size up to: $250,000

Pros

- Low Barrier to Entry for Traders

- Risk-Controlled Evaluation.

- Scalable Talent Pipeline.

- Brand Growth & Community.

Cons

- High Dropout/Failure Rate.

- Evaluation Abuse.

- Operational Overhead.

6. FundingTicks

FundingTicks is a futures trading platform that offers evaluation challenges for traders aiming to access funded accounts. Unlike traditional firms, FundingTicks charges a one-time fee without monthly or activation costs. They provide various account sizes and evaluation types, including Instant, Static, and End of Day (EOD) challenges.

Features of FundingTicks

- Evaluation Process: enforces strict rules against certain trading strategies to maintain fairness and integrity.

- Platform Support: Tradovate, NinjaTrader, TradingView.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Single-phase evaluation with fixed drawdown limits.

- Account size up to: $100,000

Pros

- One-Time Fee (No Monthly Charges).

- Fast Evaluation (As Few as 2 Days).

- High Payout Potential.

Cons

- Limited Account Sizes.

- Strict Trading Rules.

- Newer Firm

7. FXIFY

The FXIFY program is a proprietary trading challenge designed for experienced traders seeking to demonstrate their skills and gain access to funded accounts.

Features of FXIFY

- Evaluation Process: designed for experienced traders looking to earn a funded account by proving their skills under live-simulated market conditions.

- Platform Support: Project X.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: To promote stable and consistent trading, FXIFY enforces a 40% consistency rule for Expert accounts during the live stage.

- Account size up to: $400,000

Pros

- High Maximum Funding.

- No Time Limits.

- Low Minimum Trading Days

- Reasonable Profit Targets

Cons

- Trailing Drawdown.

- Strict Risk Rules.

- No Account Sharing

8. Humble Futures

Humble Futures Funding is a proprietary trading firm that offers futures traders the opportunity to trade with company capital after successfully completing an evaluation process. This model allows traders to showcase their skills without risking personal funds.

Features of Humble Futures

- Evaluation Process: offers an evaluation process designed to assess a trader’s skills and risk management abilities before providing access to a funded trading account.

- Platform Support: Rithmic.

- Profit Sharing: The profit split is 25K then 90/10.

- Trading Rules: To ensure that traders demonstrate consistent profitability, Humble Futures Funding may enforce a consistency rule during the evaluation phase.

- Account size up to: $150,000

Pros

- No Minimum Trading Days.

- Reasonable Contract Sizing.

- Profit Share After Funded Phase.

- Simple Evaluation Process.

Cons

- New and Relatively Unknown.

- Red Flags on Domain Hosting.

- No Fully Automated or High-Frequency Trading

9. The Futures Desk

The Futures Desk refers to a specialized team or division within a financial institution (like an investment bank, hedge fund, or trading firm) that focuses on futures markets.

Features of The Futures Desk

- Evaluation Process: refers to how trading firms, banks, or hedge funds assess the performance and risk of traders, strategies, or the desk as a whole.

- Platform Support: Rithmic ProjectX.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: Protect the firm and clients from unethical or reckless trading behavior.

- Account size up to: $50,000

Pros

- High Earning Potential.

- Global Market Exposure.

- Leverage and Efficiency.

Cons

- High Stress and Pressure.

- Long and Odd Hours.

- Regulatory Burden.

10. FundedNext

FundedNext is a proprietary trading firm established in March 2022 by Abdullah Jayed. Headquartered in the UAE with additional offices in Cyprus, the firm has rapidly gained traction in the prop trading industry.

Features of The FundedNext

- Evaluation Process: designed to assess traders’ skills and risk management before granting access to a funded account.

- Platform Support: Tradovate, TradingView, Ninja.

- Profit Sharing: The profit split is 100%.

- Trading Rules: Traders must not exceed a 5% loss of the initial account balance on any given day.

- Account size up to: $100,000

Pros

- High Profit Splits

- Flexible Trading Models.

- Scalable Funding.

Cons

- Upfront Evaluation Fees.

- Risk Management Rules

- No Free Trial.

11. Legends Trading

Legends Trading is a trading education and funding platform catering to both aspiring and experienced traders. It offers two main programs: one focused on stock and options trading, and another centered on futures trading.

Features of The Legends Trading

- Evaluation Process: Maintain consistent performance and risk management to qualify for real funding.

- Platform Support: Tradovate, Ninja, TradingView.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: The 30% max single-day profit rule still applies.

- Account size up to: $250,000

Pros

- High Profit Split

- No Daily Loss Limit.

- Low Barrier to Entry.

Cons

- No Refunds.

- Strict Rule Enforcement

- Trailing Drawdown Can Be Unforgiving.

12. Earn2Trade

Earn2Trade is a prop trading firm that offers aspiring traders a structured path to becoming funded professionals through education, simulated trading evaluations, and partnerships with trading firms. Founded in 2016, it has gained recognition for its transparent processes and supportive community.

Features of The Earn2Trade

- Evaluation Process: a simulated trading challenge that tests your ability to trade futures profitably and with proper risk management.

- Platform Support: Rithmic, NinjaTrader.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: No single trading day can make up more than 30% of your total profits.

- Account size up to: $400,000

Pros

- Strong Educational Support

- High Profit Split.

- Multiple Evaluation Options.

Cons

- Only Futures Trading.

- Strict Evaluation Rules

- No Free Trial.

13. Trading Pit

The Trading Pit is a proprietary trading firm that offers traders the opportunity to manage substantial capital upon passing their evaluation process

Features of The Trading Pit

- Evaluation Process: offers multiple evaluation programs across different asset classes — including Forex, CFDs, Indices, Commodities, and Futures.

- Platform Support: Tradovate, NinjaTrader, TradingView.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: You must trade for at least 10 active trading days to ensure consistent performance.

- Account size up to: $100,000

Pros

- Wide Market Access

- Profit Split up to 80%.

- Capital Scaling up to $1,000,000+.

Cons

- No Free Trial.

- Strict Rules in Some Programs.

- Reset Fee for Failures.

14. Alpha Futures

Alpha Futures is a proprietary trading firm specializing in futures trading.

Features of The Alpha Futures

- Evaluation Process: designed to assess a trader’s ability to achieve consistent profitability while adhering to risk management rules. The firm offers flexibility in trading days and position sizes, with a focus on disciplined trading practices..

- Platform Support: Tradovate, Ninja, ProjectX.

- Profit Sharing: The profit split is 70/30.

- Trading Rules: Traders must use Alpha Futures’ proprietary platform, AlphaTicks, which integrates TradingView for advanced charting tools.

- Account size up to: $450,000

Pros

- Simple One-Step Evaluation

- Low Monthly Cost.

- No Time Limit.

Cons

- Strict Consistency Rule (Standard Accounts).

- Limited Max Account Size

- No Automated Trading.

15. Purdia Capital

Purdia Capital is a proprietary trading firm that offers both evaluation-based and instant funding programs for futures traders. Founded in December 2022, the firm has quickly gained attention for its trader-friendly policies and transparent funding process

Features of The Purdia Capital

- Evaluation Process: You pay a monthly fee to trade on a simulated (demo) futures account and must hit a profit target while staying within risk limits.

- Platform Support: Tradovate, NinjaTrader, Tradingview, Rithmic.

- Profit Sharing: The profit split is 70/30.

- Trading Rules: Traders are required to trade for a minimum number of days, typically 5, to ensure consistent performance.

- Account size up to: $100,000

Pros

- Trader-Friendly Funding Model

- Generous Profit Split.

- Comprehensive Support and Education.

Cons

- Higher Evaluation Costs.

- Limited Live Account Availability

- Activation Fees on Evaluations.

Conclusion

Selecting the right prop trading firm is an important decision that will impact your trading journey significantly. The firms listed above each offer unique features and benefits designed to help traders succeed. Whether you’re looking for educational resources, advanced trading platforms, or flexible funding options, a prop trading firm meets your needs.

I also link these firms to their original sites to save you time. Evaluate these firms based on your trading style, goals, and the specific features that will support your success in the competitive world of futures trading.