Top Best Future Prop Firms in 2024

In futures trading, proprietary (prop) trading firms offer a unique opportunity for traders to access significant capital and advanced tools without risking their funds. Whether you’re a trader or just getting started, choosing the right prop trading firm can substantially impact your trading success.

Below, I list the top 10 best future prop firms making waves in 2024 and offer detailed insights into what makes each stand out.

Best Future Prop Trading Firms

1. My Funded Futures

My Funded Futures is a prominent name in the prop trading world, known for its flexible funding options and a strong, supportive trading community. Traders can choose from account sizes of $50,000, $100,000, and $150,000. This firm is known for its straightforward evaluation process, requiring only one step to qualify for a funded account.

Features of My Funded Futures:

- Evaluation Process: Single-step evaluation with profit targets of 8% for each account level.

- Platform Support: Includes NinjaTrader, Tradovate, Rithmic R|Trader, TradingView, Quantower, Sierra Chart, Jigsaw Trading, and ATAS.

- Profit Sharing: Up to 90% profit split.

- Trading Rules: The end-of-day (EOD) drawdown rule is set at the initial balance plus $100. The minimum trading day requirement is one day.

- Automated Trading: Fully automated systems are prohibited; semi-automated systems are permitted.

- Account size up to: $150,000

Pros

- High-profit split of 90%.

- Wide range of supported trading platforms.

- Simple, single-step evaluation process.

Cons

- Strict rules against automated trading.

- No free trials or free repeat evaluations.

2. Leeloo Futures

Leeloo Futures is recognized for its innovative approach to prop trading, combining cutting-edge technology with user-friendly platforms to create an optimal trading experience.

Features of Leeloo Futures

- Location: United States

- Evaluation Process: Multiple account sizes with varying profit targets.

- Platform Support: Includes NinjaTrader and others.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Flexible rules designed to accommodate different trading styles.

- Account size up to: $300,000

Pros

- Competitive profit sharing model.

- Support for a variety of trading platforms.

- Flexible evaluation and trading rules.

Cons

- Profit split may vary depending on account size.

- The evaluation process can be complex for beginners.

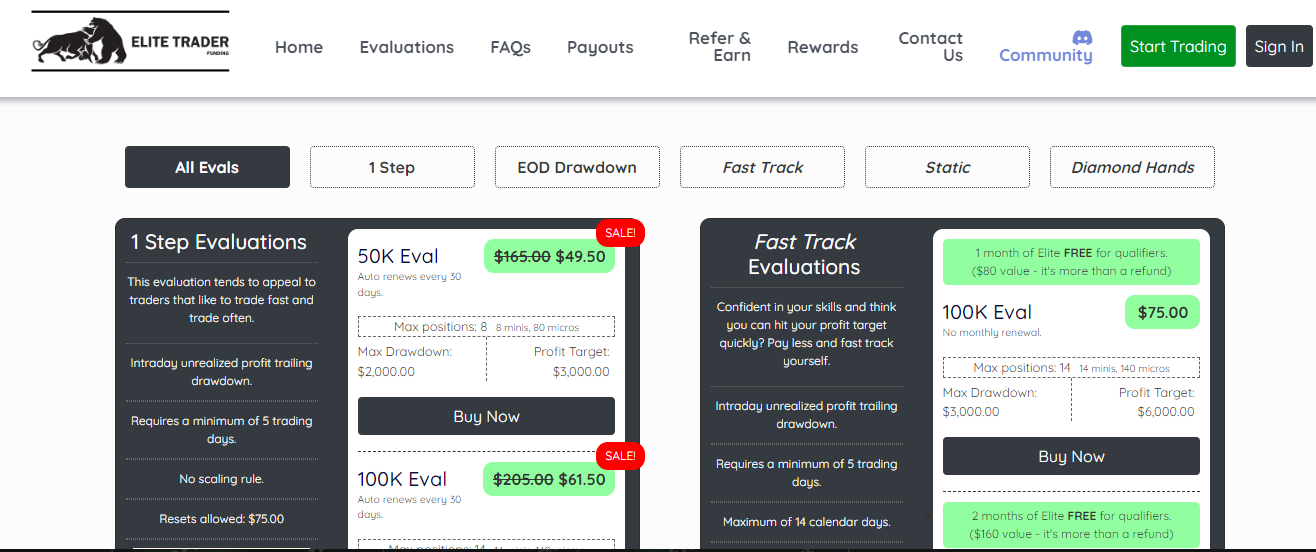

3. Elite Trader Funding

Elite Trader Funding stands out for its comprehensive funding programs and a strong emphasis on trader development. The firm is dedicated to helping traders reach their full potential through professional coaching and robust support systems.

Features of Elite Trader Funding

- Location: United States

- Evaluation Process: Detailed evaluation with specific profit and drawdown targets.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: Clear rules designed to support consistent trading performance.

- Account size up to: $300,000

Pros

- Robust support for various trading platforms.

- High-profit split encouraging trader performance.

- Detailed and transparent evaluation process.

Cons

- Higher initial costs for some account sizes

- Stringent evaluation criteria

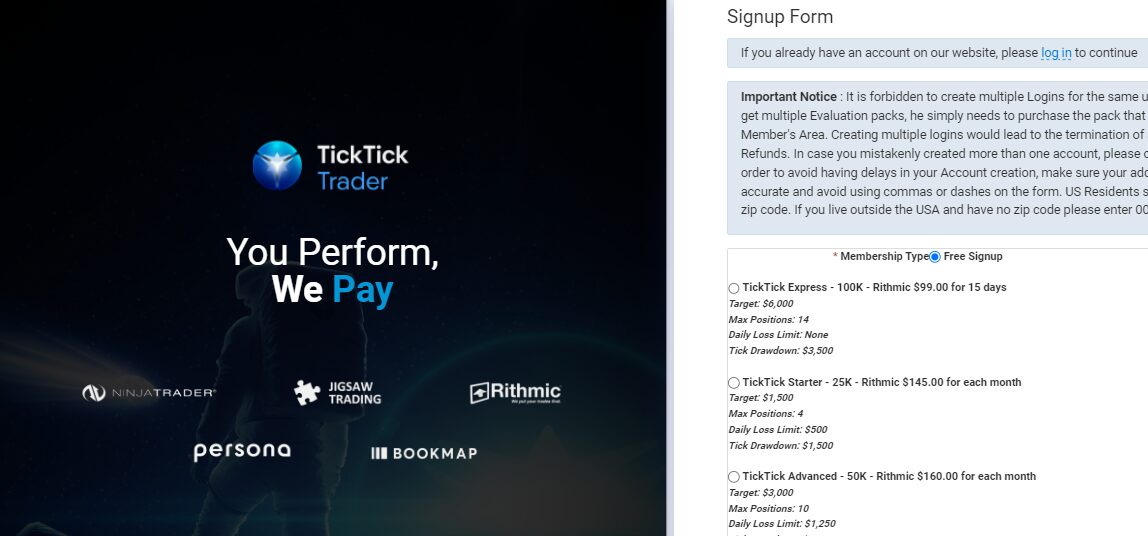

4. Tick Tick Trader

Tick Tick Trader is known for its streamlined trading experience, offering straightforward funding criteria and fast evaluations. The firm aims to make the funding process as efficient and transparent as possible.

Features of Tick Tick Trader

- Location: Romania.

- Evaluation Process: Simple and clear evaluation steps.

- Platform Support: Supports multiple trading platforms, including NinjaTrader.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Designed to be trader-friendly with minimal restrictions.

- Account size up to:$100,000

Pros

- Support for multiple platforms.

- Trader-friendly rules.

- Request payouts at any time.

- Simple evaluation process.

Cons

- Profit sharing may vary.

- 3 funded accounts limit.

- Limited to futures trading.

5. Flexy Trade

Flexy Trade offers a unique proposition with its highly customizable trading programs and flexible funding options, catering to a wide range of traders.

Features of Flexy Trade

- Location: U.S. state of Wyoming.

- Evaluation Process: Multiple account sizes with varying profit targets.

- Platform Support: Includes NinjaTrader and others.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Flexible rules designed to accommodate different trading styles.

- Account size up to: $100,000

Pros

- Trade during holidays/news.

- Flexible evaluation and trading rules.

- Support for a variety of trading platforms.

- Competitive profit sharing model.

Cons

- Live trailing drawdown during the evaluation.

- The evaluation process can be complex for beginners.

- Profit split may vary depending on account size.

6. Take Profit Trader

Take Profit Trader excels in providing a balanced approach to trading, focusing on profitability and sustainable growth. The firm aims to create a stable environment where traders can thrive.

Features of Take Profit Trader

- Location: United States.

- Evaluation Process: Clear and straightforward evaluation.

- Platform Support: Supports multiple trading platforms.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: Trader-friendly with minimal restrictions.

- Account size up to: $150,000

Pros

- Realistic profit targets.

- Instant Withdrawal process.

- Clear evaluation process.

- Support for multiple platforms.

Cons

- Limited to futures trading.

- Free trials are not available.

- Profit sharing may vary.

7. Blusky Trading

Blusky Trading is known for its exceptional customer service and comprehensive trader support, making it a preferred choice for many traders.

Features of Blusky Trading

- Location: St. Petersburg, Florida, USA.

- Evaluation Process: Flexible and straightforward evaluation.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Designed to accommodate various trading strategies.

- Account size up to: $100,000

Pros

- Custom profit split increases if the performance increases.

- Flexible evaluation process.

- Strong platform support.

Cons

- Evaluation can be demanding.

- Unlike other companies, there are fewer account sizes.

- Higher initial costs for larger accounts

8. Fast Track Trading

Fast Track Trading is designed for traders who want to accelerate their trading careers with fast funding and robust support. The firm focuses on providing the resources needed for rapid growth and success.

Features of Fast Track Trading

- Location: Orlando, United States.

- Evaluation Process: Simple and clear evaluation steps.

- Platform Support: Supports multiple trading platforms, including NinjaTrader.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Designed to be trader-friendly with minimal restrictions.

- Account size up to: $3,000,000

Pros

- rade during holidays/news.

- Simple evaluation process.

- Support for multiple platforms.

- Trader-friendly rules.

Cons

- If you skip the evaluation, it will cost more.

- Limited to futures trading.

- Profit sharing may vary.

9. Phidias Prop Firm

Phidias Prop Firm offers a comprehensive suite of tools and resources to empower traders and maximize their potential. The firm focuses on providing a robust support system and flexible trading options.

Features of Phidias Prop Firm

- Location: Gibraltar, United Kingdom.

- Evaluation Process: Flexible and straightforward evaluation.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Designed to accommodate various trading strategies.

- Account size up to: $1,000,000

Pros

- Offers also swing trading accounts.

- High-profit split.

- Flexible evaluation process.

- Strong platform support.

Cons

- Not Offers educational content.

- Evaluation can be demanding.

- Higher initial costs for larger accounts.

10. Trade Day

Trade Day stands out among futures prop trading firms for its commitment to innovation and trader empowerment. Focusing on futures markets, Trade Day offers aspiring traders the opportunity to trade with substantial capital provided by the firm. Their advanced trading platforms and robust risk management tools ensure traders can execute trades efficiently and manage risks effectively.

Features of Trade Day

- Location: United States.

- Evaluation Process: Flexible and straightforward evaluation.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 90/10.

- Trading Rules: Designed to accommodate various trading strategies.

- Account size up to: $250,000

Pros

- Traders receive excellent support.

- Free Trail available.

- Advanced Trading Tools

- High-Profit Potential

Cons

- It cannot trade on the news.

- The evaluation process can be challenging, requiring a high level of skill.

- High Initial Fees

11. OneUp Trader

OneUp Trader has established itself as a leader in futures prop trading by offering flexible funding options and comprehensive support to traders worldwide. Specializing in futures contracts, OneUp Trader provides traders with the capital and resources necessary to succeed in volatile market conditions. Their emphasis on performance evaluation and continuous improvement makes them a preferred choice for ambitious futures traders.

Features of OneUp Trader

- Location: United States.

- Evaluation Process: Flexible and straightforward evaluation.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: Designed to accommodate various trading strategies.

- Account size up to: $250,000

Pros

- he rapid evaluation process means traders can access funding quickly.

- The absence of monthly fees makes OneUp Trader an affordable choice for many.

- Great customer support.

- Traders enjoy considerable flexibility in their trading strategies and risk management.

Cons

- Minimum $1000 withdrawal amount.

- OneUp Trader offers less educational and mentorship support.

- The fast-paced evaluation process can be intense and may not suit all traders

12. Topstep

Topstep has carved a niche in the futures prop trading industry with its innovative trader development and risk management approach. Offering traders the opportunity to trade futures markets with firm capital, Topstep provides a structured path to becoming a funded trader. Their proprietary trading evaluation process and supportive community environment empower traders to achieve consistent profitability and growth.

Features of Topstep

- Location: United States.

- Evaluation Process: Flexible and straightforward evaluation.

- Platform Support: A wide range of trading platforms is supported.

- Profit Sharing: The profit split is 80/20.

- Trading Rules: Various trading strategies are designed for the best performance.

- Account size up to: $150,000

Pros

- Strong Community

- An extensive library of educational content.

- The evaluation process ensures that only the most skilled and disciplined traders get funded.

Cons

- The evaluation process can be demanding and time-consuming.

- Only future trading

- The fees associated with Topstep’s programs can be higher than some other firms.

Conclusion

Selecting the right prop trading firm is an important decision that will impact your trading journey significantly. The firms listed above each offer unique features and benefits designed to help traders succeed. Whether you’re looking for educational resources, advanced trading platforms, or flexible funding options, a prop trading firm meets your needs.

I also link these firms to their original sites to save you time. Evaluate these firms based on your trading style, goals, and the specific features that will support your success in the competitive world of futures trading.